How to Place a Buy Order in Intraday trade

In this article, we will choose a stock Wipro just as a demo purpose.

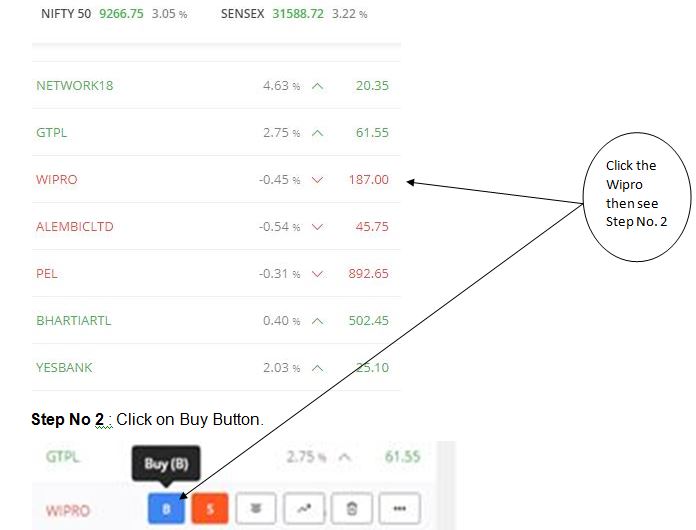

Step 1: Tap on that stock from your Watch list and the below screen will be shown, click on Wipro.

Step No 3: After clicking on Buy Button, below window will open for intraday trade, then Select the MIS and always put Limit Price then fill the quantity then click the Buy button.

Step 4: Check-in Order book. When your limit price will come then your order will automatically execute and your order will complete, therefore it will show in position.

Step 5: Click on Position then you will see your profit and loss at a particular time.

Note: It is mandatory to close MIS positions on the same day, generally 3:20 pm for Equity.

- If you want to Buy order the stock at the market price, select Market as shown in below image. It will be executed at the available price. You can see how the price column is greyed out, as you cannot choose the price for its execution. Rest all process remain the same as earlier told above.

How to Place a Sell Order in Intraday trade

Step 1: Tap on that stock from your Watch list and the below screen will be shown, click on Wipro.

Step No 3 : After click on Sell Button, window will open for intraday trade, then Select the MIS and always put Limit Price then fill the quantity then click the Buy button.

Step 4: Check-in Order book. When your limit price will come then your order will automatically execute and your order will complete, therefore it will show in position.

Step 5: Check-in Position then you will see your profit and loss at a particular time.

Note: It is mandatory to close MIS positions on the same day, generally 3:20 pm for Equity.

- If you want to Sell order the stock at the market price, select Market as shown in below image. It will be executed at the available price. You can see how the price column is greyed out, as you cannot choose the price for its execution. Rest all process remain the same as earlier told above.

How to Place a Stop-loss in Intraday trade

In trading, it is important to maximize your gain, but what is more important is to minimize the loss. When you have entered into a trade and want to limit your losses, this is the order you need to use.

For Buy-Side only (Applicable for Intraday trade only)

For example, If you bought Wipro @170/- and you don’t want to sell it below 165/- i.e. Maximum 5 Rupees loss.

Then you can use SL order as below, Set the trigger price at 165.00 only. Once Price will come the order will be executed.

For Sell-Side only (Applicable for Intraday trade only)

For example, If you sell Wipro @170/- and you don’t want to buy it above 175/- i.e. Maximum 5 Rupees loss.

Then you can use SL order as below, Set the trigger price at 175.00 only. Once Price will come to the order will be executed.

For Buy-Side only (Applicable for Delivery trade only)

For example, If you bought Wipro @180/- and you don’t want to sell it below 175/- i.e. Maximum 5 Rupees loss.

Then you can use SL order as below, Set the trigger price at 165.00 only. Once Price will come the order will be executed.

How to Place Stop Loss Market Order

You can also use it to enter into a trade once it reaches a particular price. For example the immediate price after support or resistance. Let’s understand this with examples;

For Stop Loss Market Order (Applicable for Buy side only)

Suppose you believe that once the stock crosses 180 there could be a substantial upside, so you want to buy it only if it crosses 180. Then put the ‘Trigger Price’ as 180 and the price at which you want to buy or make it SLM (SLM will ensure that your buy order gets fulfilled at the best available price)

For Stop Loss Market Order (Applicable for sell side only)

Suppose you want to sell a stock only if it goes below 155, as you believe that once it goes below 155 there could be a substantial downside Then put the trigger as 155 and then put your limit price or make it SLM

Note: Differentiate between Limit Order and Stop Loss order; don’t get confused between the two. In Limit order, your order will be filled once it reaches that price, whereas in Stop Loss order your order is placed only when the trigger price is met and then it will be executed.

Key terms explained

CNC: Cash and Carry, you can take delivery and keep these stocks in your Demat once bought.

MIS: Margin Intraday Square off, the position needs to be square off on the same day before the market close. For Equity, the MIS position square off time limit is before 3:20 pm

Note: In case you enter into the MIS position and don’t square off by the cut off time, only then the MIS orders are closed by the backend team (if possible). In Zerodha for such assistance, there is a charge levied called ‘Call & Trade’ charges @ ₹50/- plus GST (Check with your broker for further details & if there are any revision in Timings and Charges).

Limit order Vs Market Order

Limit Order | Market Order |

In Limit Order you specify the price at which you want to execute the trade, they are executed at that price OR better price if available. | In Market order, the trade is executed as quickly as possible at the market price i.e. the best available price. |

It is executed only when the price reaches the level that was specified. | It is normally executed on an immediate basis. |

Ex: Mr. N wants to Buy shares of Wipro Ltd @160, so he will set the limit order with price 160/- So when Wipro is trading at 160 or below his order will be executed. | Ex: Mr. N wants to Buy Wipro at the market price, say 1000 quantity. So his order will be executed by buying the quantity starting from the lowest available price till the order is fulfilled for 1000 quantity. |

Exiting a position

Click on the stock in your Position/Holdings tab and click on EXIT.

Follow the same steps for placing the order as mentioned earlier.

Note: Depository participant (DP) charges are levied for every stock you sell from your Demat account after taking delivery. But if you square off your position the same day, then that means there is no delivery and thus consequently no DP charges are levied for such transactions. There are no DP charges on the Buying side.

Depository participant charges are ₹13.5 plus GST per scrip per day, irrespective of quantity traded or the number of orders. They are levied only on the Sell-side of CNC stocks.

I can’t insert message in telegram chanal.message box not available only seen mute

Nice information thanks

Thank you sir for provide such information,

I want to know a little thing, If I use stop loss in CNC order (Already buying order executed), and order will not executed (sell order/stop loss) till market close, what will happen?

My CNC sell order (which is used for stop loss) will cancelled or not

If cancelled then should I go through the GTT order? If I go with the GTT order but next treading day share will open in gap down, then what to do.

Pls inform how to Buy and sell the order in Shearkhan pls pls sir

Sir try to same thing in UPSTOX APP ..

Nice sir, cleared the doubt.

Very nicely detailed .Neel sir I have not seen person doing such micro handholding for your clients .

If I want open Zaroda account can you help me the process .

Currently I am with Icici direct .

Regards

Kailas

9136339926

Actually I am not holding zerodha dmate account. I m holding with angle broking. The format is different.

Like!! I blog frequently and I really thank you for your content. The article has truly peaked my interest.