What is volume

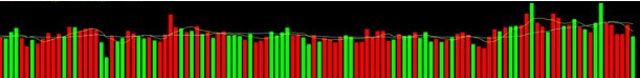

It is one of the simple tools and shows the total number of buyer and a total number of the seller, who exchanging the shares during a period of time in a day. When volume will high at that timeshare is more active.

A trader is also focusing on volume bar during the short term intraday trade. For example:-

If the volume of the stock in a day was 5,00,000 shares, it means that 5,00,000 shares were sold by any trader and any trader bought those share on that day.

But with the help of only volume data, you can’t able to earn a profit. You to combine other data with volume so that you can make a good profit in a short period. Using volume with Resistance and support of the stock price is very supportable data during the trade.

So once any breakout or breakdown of critical support and resistance level with high volume is reliable but volume should move along with market trend.

If the stock price is in an uptrend then volume should increase along with the market trend. There is some unique shortcut to help in short term trade in case of volume.

How does volume Works

- When Volume is increasing and the price is also increasing it means it is a bullish sign for a stock price.

- When Volume is decreasing and the price is also decreasing it means it is a bullish sign for a stock price.

- When Volume is increasing and the price is also decreasing it means it is a bearish sign for a stock price.

- When Volume is decreasing and the price is also increasing it means it is a bearish sign for a stock price.

Important Strategies about Volume

- When the market trend is bullish and volume is also high then the market will make a new high.

- When the market trend is bullish and volume is very low then the market will make a new high but it will be temporary.

- When a share price is low with high volume is a bearish Indicator.

- When a share price is low with low volume is a false indicator.

- When market rally on a high price with increasing volume but activities is very less it means it indicates price reversal in market trend.

- When market rally on decreasing volume is a false indication, so thereafter price will be a reversal.

Leave a Reply